Alberta: Massive Pre-Seed Funding Gap Despite Record VC Investment

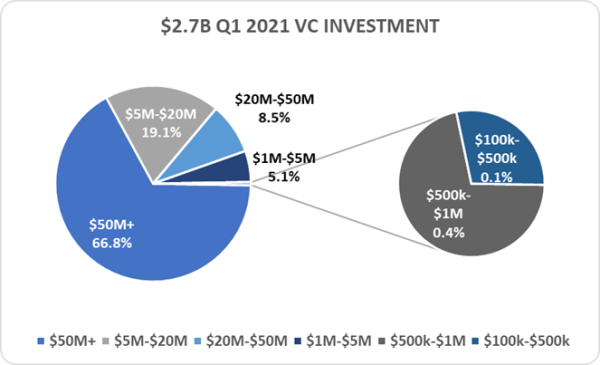

Canada recorded $2.7 billion of VC investment in Q1 2021, its highest quarterly VC investment on record. The average deal size in Q1 of $15.2 million is also a record high. Alberta has seen similar recent results.

It sounds like the investment dollars are flowing and all is well. Do these headlines really signal the maturation of Alberta’s technology ecosystem? Or do they hide a serious challenge?

We believe the underlying data highlights a significant divergence between the needs of today’s early-stage founders and the evolving role of traditional venture capital funds. Alberta faces a massive pre-seed funding gap as a result.

The data clearly indicates a significant divergence between the type of capital needed by Alberta’s pre-revenue and early-revenue founders and the types of deals most traditional sources of early-stage capital will invest in today. There is extremely limited supply of true early-stage risk capital focused on the needs of companies with less than $500,000 in revenue.

For Founders $500,000 is the New $5 Million

Today, the capital needs of founders in the very early stages of development have reached record lows. The advancement of new technologies, including cloud computing, have reduced the cost to establish a business to a fraction of what it was 10 years ago. Founders of pre-revenue and early-revenue companies no longer need a $5 million investment to build a team, an initial product, and gain some market traction.

$500,000 is the new $5 million

Access to $500,000 funding rounds is now critical for founders to achieve these early milestones.

We've been investing locally in this size of round for the past year and we see demand for this kind of capital every day. In Alberta it is the most difficult round for founders to raise.

For Series A/B Funds $10 Million is the New $5 Million

While early-stage founders need less capital, venture capital funds have been getting bigger and bigger. Most capital is now raised in funds raising $250 million or more with many funds raising more than $1 billion. Venture funds that large simply cannot focus on making $500,000 investments to deploy their capital efficiently.

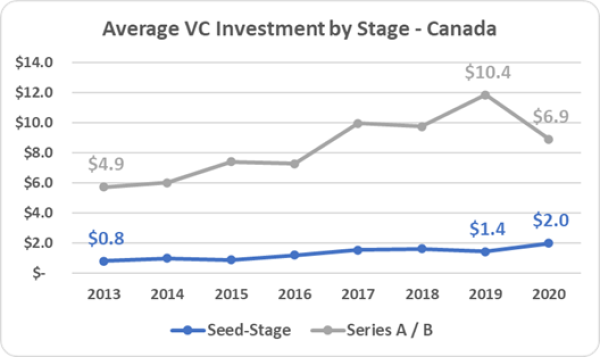

In Canada, this is reflected through a steadily growing average investment size. This is displayed in the CVCA data presented in the chart below.

The average Series A/B investment size in Canada has grown from roughly $5 million in 2013 to over $10 million in 2019.

While seed-stage investments are targeted to earlier stage companies than Series A rounds, they have been following the same trend and saw the highest average deal size on record in 2020 at $2 million.

The decrease in average Series A/B deal size in 2020 could be a result of COVID and reflect companies' desires to raise less capital at valuations that were likely depressed due to economic uncertainties. Time will tell if this signals a change in trends or not.

Small Deal Sizes Neglected by Venture Funds

We believe smaller $500,000 deal sizes are critical to pre-revenue and early-revenue companies today. But these smaller deal sizes are being neglected in favour of much larger investments.

The chart above shows that only 0.1% or $4 million of the record $2.7 billion of venture capital invested in Canada in Q1 2021 was invested in $100,000 to $500,000 deal sizes.

Only 0.4% or $10 million was invested in $500,000 to $1 million deal sizes.

The $50 million and over deal size category accounted for roughly 67% of all capital invested.

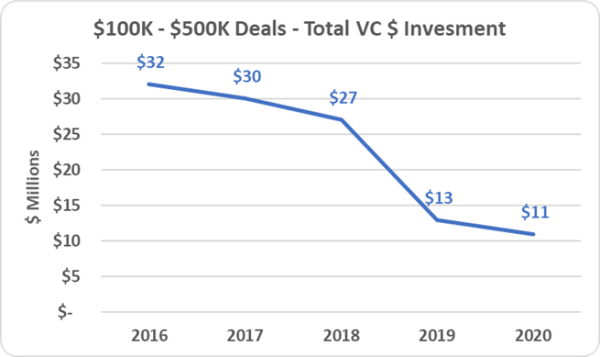

Total capital invested in the $100,000 to $500,000 deal size category in Canada has been steadily declining for years and in 2020 represented only one third of the total dollars invested in 2016. This is highlighted below.

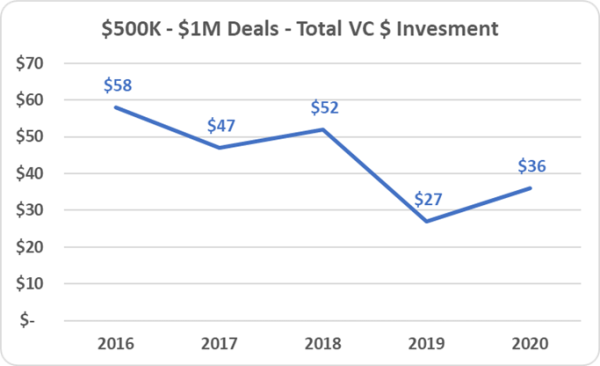

The $500,000 to $1 million deal size category has also been shrinking.

The availability of capital to these critical deal sizes has diminished just as their importance has escalated.

Angel Investors Move into Larger Deals

Angel investors are traditionally among the first investors to support companies when their capital needs are much smaller. However, these investors are also investing in larger deals and appear to have moved into the gap opened as venture fund deal sizes have grown.

.png?resize=600x0)

According to the NACO’s 2019 Report on Angel Investing in Canada, the average deal size NACO angel investors participate in grew to $2.9 million in 2019. This is 240% larger than the $1.2 million average in 2015, as presented above.

The Alberta Story

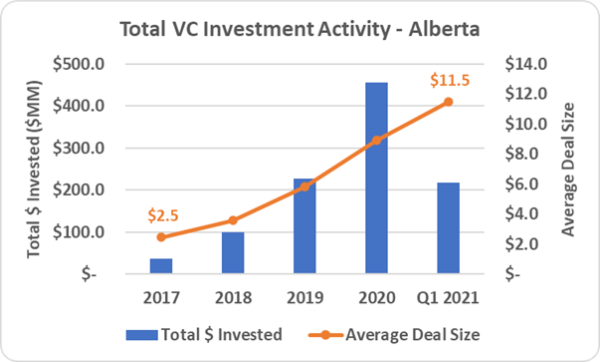

Alberta has seen similar venture capital investment trends as Canada. CVCA data shows total venture capital invested has increased substantially reaching a record high of $455 million in 2020. Average deal sizes have grown by more than 4 times since 2017 to reach $11.5 million in Q1 2021.

But this record amount of investment remains focused on large deal sizes. Investments in only 4 companies (Jobber, Neo Financial, Attabotics and Symend) accounted for $265 million or 58% of 2020 total. That leaves a lot less capital to go around to other investments.

According to data provided in Hockeystick's 2020 Calgary Tech Report, there were only 8 investments reported in the $250,000 to $1.0 million deal size category across all of 2019 and 2020. Most capital was allocated to much larger deal sizes, as highlighted below.

.png?resize=600x0)

It is true that other deals in this range were likely completed locally and not reported. However, the reported data highlights the point that the main established Canadian funds who do report are not investing in smaller deals.

$500,000 Investment Rounds are Critical in Alberta

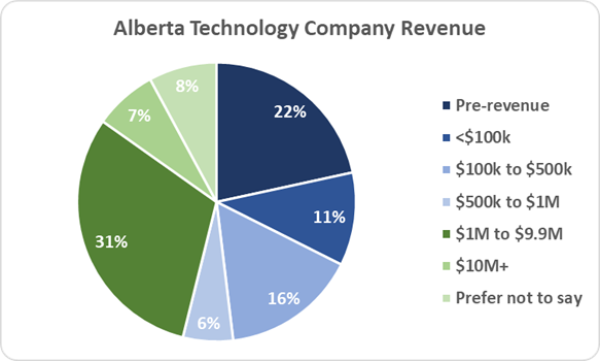

Alberta is an emerging ecosystem where 55% of the more than 3,000 technology companies identified in the 2021 Alberta Technology Deal Flow Study are early in their lifecycle and have less than $1 million in revenue. 49% have less than $500,000 in revenue. This is highlighted below.

58% of these companies indicate a need to raise capital.

58% also indicate the biggest challenge they face is access to capital.

Companies with less than $500,000 in revenue cannot access a $10 million Series A round.

Most cannot access a $2 million Seed round.

Companies with less then $500,000 in revenue typically need to raise between $500,000 and $1 million. Precisely the range of investments that are most neglected today.

A Massive Pre-Seed Funding Gap Exists in Alberta

The data clearly indicates a significant divergence between the type of capital needed by Alberta’s pre-revenue and early-revenue founders and the types of deals most traditional sources of early-stage capital will invest in today. There is extremely limited supply of true early-stage risk capital focused on the needs of companies with less than $500,000 in revenue.

A massive pre-seed funding gap exists as a result.

We believe there is demand in Calgary alone for between $100 million and $250 million of pre-seed capital.

Yet, many founders remain unable to access capital to grow when they need it the most. Some are forced to leave Alberta to source capital elsewhere. Others struggle for so long that their opportunity passes them by.

Yes, Alberta-based companies received some large venture capital investments in the past year. Those certainly helped to put the province on the map.

However, Alberta’s technology investment ecosystem does not truly support founders across all stages of the start-up lifecycle.

Alberta will be unable to systematically build these success stories in the future if the pre-seed funding gap is left unaddressed.